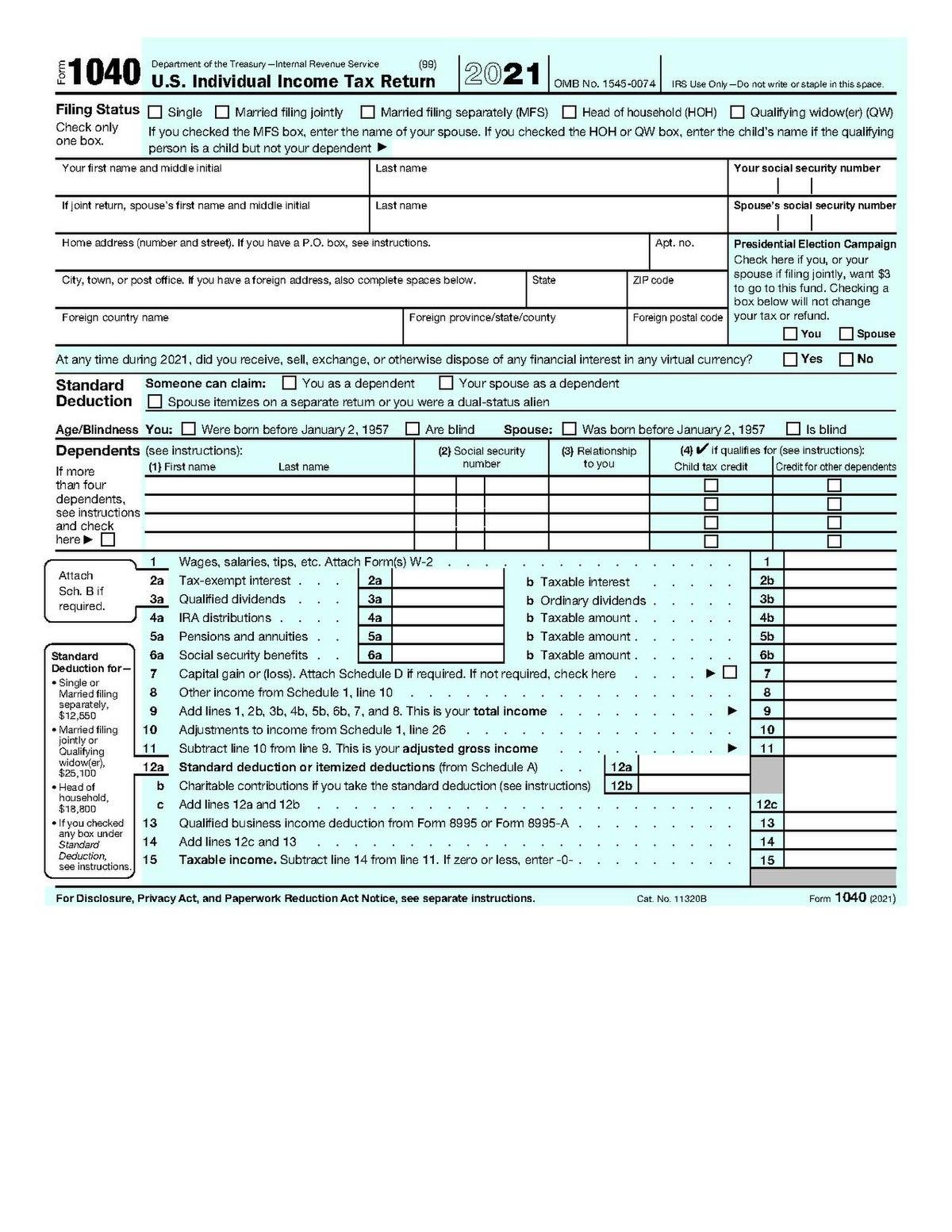

Hey there, fellow content creators! If you’ve ever dreamed of turning your passion for YouTube into a money-making venture, you’re definitely in the right place. Picture this: you wake up, pour yourself a cup of coffee, and as you sip, you see notifications pinging on your phone—your latest video is racking up views, and guess what? That’s translating into real income! But if you’re thinking about diving into the YouTube income pool, you need to be aware of something crucial: the 540 Schedule X.

Now, before you start feeling overwhelmed, take a deep breath! This guide is designed to be your sidekick in the wild world of YouTube finances. We’ll break down everything you need to know about mastering Schedule X, so jargon and financial lingo won’t stand in your way. Whether you’re a seasoned vlogger or just starting out, understanding how to navigate this schedule can make a world of difference in maximizing your income and ensuring you stay on the right side of the IRS. So, let’s roll up our sleeves and turn this seemingly complex tax form into a straightforward tool for your YouTube success! Are you ready? Let’s dive in!

Unlocking the Secrets of the 540 Schedule X and YouTube Monetization

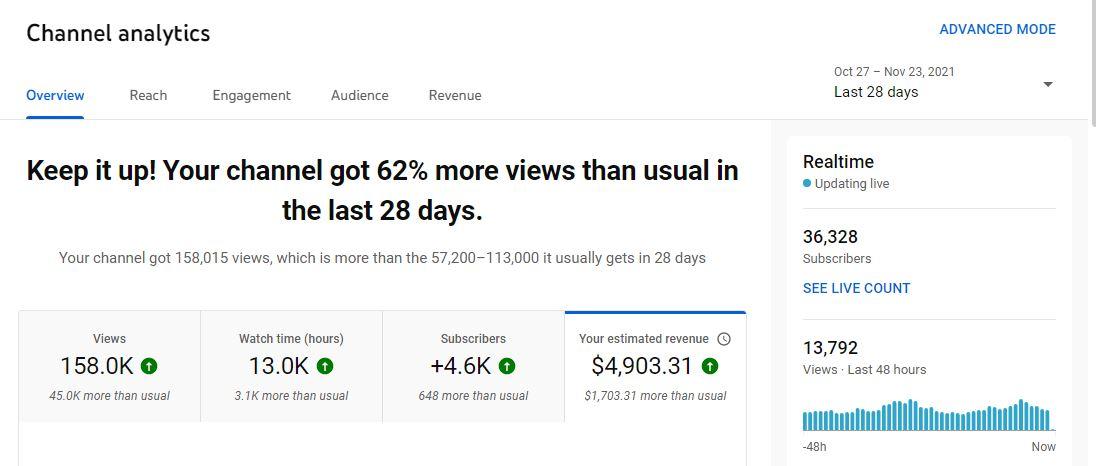

Understanding the intricacies of the 540 Schedule X is like deciphering a treasure map that leads you to the bountiful rewards of your YouTube income. When you start raking in those sweet ad dollars, sponsorships, or merch sales, it’s essential to keep track of every penny. Making use of the 540 Schedule X allows you to document your earnings accurately, ensuring you’re not missing out on potential deductions. Include everything from Google AdSense revenue to any money you make from affiliate links. It might seem like a chore, but think of it as giving your finances a much-needed spa day—clean and rejuvenated!

Now, let’s talk taxes. Yes, the T-word that makes everyone cringe! But with a little insight, it doesn’t have to be terrifying. You’ll want to collect all your relevant YouTube earnings documentation—think income statements, 1099 forms, and invoices. Organizing your records can feel like a daunting task, but breaking it down is key. Consider setting reminders every month to gather your earnings, much like tidying up your room regularly. You’ll soon find that tax season doesn’t have to be a monster waiting to pounce. Instead, it can be just another facet of your channel’s growth story!

Navigating Tax Deductions: Keeping More of Your Hard-Earned YouTube Cash

When it comes to tax deductions, YouTube creators have plenty of opportunities to carve out some sweet savings. Think of your expenses like puzzle pieces; the more you find and fit together, the clearer your financial picture becomes. Your setup isn’t just a hobby; it’s an investment. Some common deductions include:

- Equipment Costs: Cameras, microphones, and editing software.

- Home Office Deductions: If you have a dedicated space just for creating your content.

- Internet and Utilities: Costs associated with running your channel.

- Marketing Expenses: Social media ads, graphic design fees, or even influencer collaborations.

The idea is to keep accurate records and receipts for these expenses. You don’t want the IRS taking a bite out of your income because you weren’t careful. To help visualize your potential deductions, check out this handy chart:

| Expense Type | Potential Deduction |

|---|---|

| Cameras & Gear | 100% of purchase price if directly used for videos |

| Home Office | Up to $1,500 for qualified expenses |

| Software & Subscriptions | 100% deductible for usage |

| Internet Costs | Proportional to business use |

Just think about it: if you’re spending money to make money, it should come back your way at tax time. Planning ahead and knowing what you can claim isn’t just smart; it’s essential. Consider it your financial safety net that keeps you afloat while you create amazing content.

Boosting Your Revenue: Strategies for Maximizing YouTube Ad Income

When it comes to boosting your revenue on YouTube, you’ve got to think outside the box. Sure, ads are great, but why stop there? Consider diversifying your income streams. Memberships and Patreon can play a huge role: loyal fans are often willing to chip in for exclusive content or behind-the-scenes looks. As you grow, explore merchandising. It’s not just about putting your logo on a T-shirt; think fun and unique items that resonate with your brand and audience. Your viewers want to feel connected to you, and offering tangible goodies can create a deeper link that also pads your wallet.

Another powerful strategy is optimizing your videos for maximum visibility. This means not just creating engaging content, but also leveraging SEO techniques. Use catchy titles and descriptions that incorporate relevant keywords to help your videos pop up in search results. Don’t forget about thumbnails—think of them as your video’s first impression; they need to draw people in! Here’s a quick table of tips to consider:

| Strategy | Description |

|---|---|

| SEO Optimization | Incorporate keywords in titles and descriptions. |

| Engaging Thumbnails | Create eye-catching designs to increase clicks. |

| Audience Engagement | Encourage comments and interactions to boost visibility. |

| Collaborations | Partner with other creators to reach new audiences. |

Understanding the IRS: Making Sense of Tax Obligations for Content Creators

Let’s face it, taxes can feel more confusing than a cat trying to catch its tail, especially when you’re making money from your YouTube channel. As a content creator, it’s essential to grasp what the IRS expects from you so you can keep your hard-earned cash safe. Understanding the difference between employee income and self-employed income is crucial because they have vastly different implications for how you file taxes. If you’re raking in that YouTube dough, you’re likely considered self-employed, which means you have to report all your earnings, even if you’re not receiving a W-2. Think of it like this: if you were a pizza maker selling slices, the IRS wants to know how many pies you’ve made—not just the ones you sold at a gig.

When it comes to filing your taxes, you’ll be digging into Schedule C to report your business income and expenses, but don’t forget about that 540 Schedule X! This piece of paper is essential for adjusting your California income to reflect any differences between your federal and state filings. You might recoup some bucks if you’ve got deductible expenses like equipment costs, software subscriptions, or even internet bills that are tied to your content creation. Here are a few common deductions you should keep an eye on:

- Camera and editing software

- Home office space

- Travel expenses for events

So, buckle up, take a deep breath, and keep those receipts handy. Navigating the world of taxes might seem daunting, but with the right knowledge under your belt, you’ll feel like the master of your financial domain—even if your creative soul really just wants to film that next big YouTube hit!

Insights and Conclusions

And there you have it, folks! You’ve journeyed through the ins and outs of mastering the 540 Schedule X like a pro. Just imagine—what once felt like a tangled web of tax forms and YouTube income is now a clear path you can navigate with confidence. It’s kind of like finally solving that tricky puzzle you’ve been staring at for ages; once you see it, it all makes sense, right?

By diving into the intricacies of Schedule X, you’re not just checking a box on your tax return; you’re taking control of your finances and making your YouTube hustle work harder for you. So, whether you’re a seasoned creator or just starting, applying these insights will not only help you maximize your earnings but also give you the peace of mind that comes with knowing you’re doing things right.

As you embark on this journey, remember that every penny counts, and mastering your tax strategy can give you more freedom to create, explore, and inspire. So go ahead and dive back into those videos and see where your creativity can take you. After all, it’s not just about earning; it’s about creating content that resonates with your audience while keeping your financial ship sailing smoothly.

Thanks for hanging out with me today! I hope you feel empowered and ready to tackle that Schedule X like a true YouTube income mastermind. Keep hustling, keep creating, and who knows? The next big thing on YouTube could be just around the corner, thanks to your savvy financial skills!